Défense, Spatial & NewSpace

Les programmes de défense, Spatial et NewSpace combinent exigences de souveraineté, contraintes export, cybersécurité renforcée et pression calendrier, dans un environnement de sous‑traitance et de coopération internationale complexe.

Des environnements à forts enjeux réglementaires et contractuels

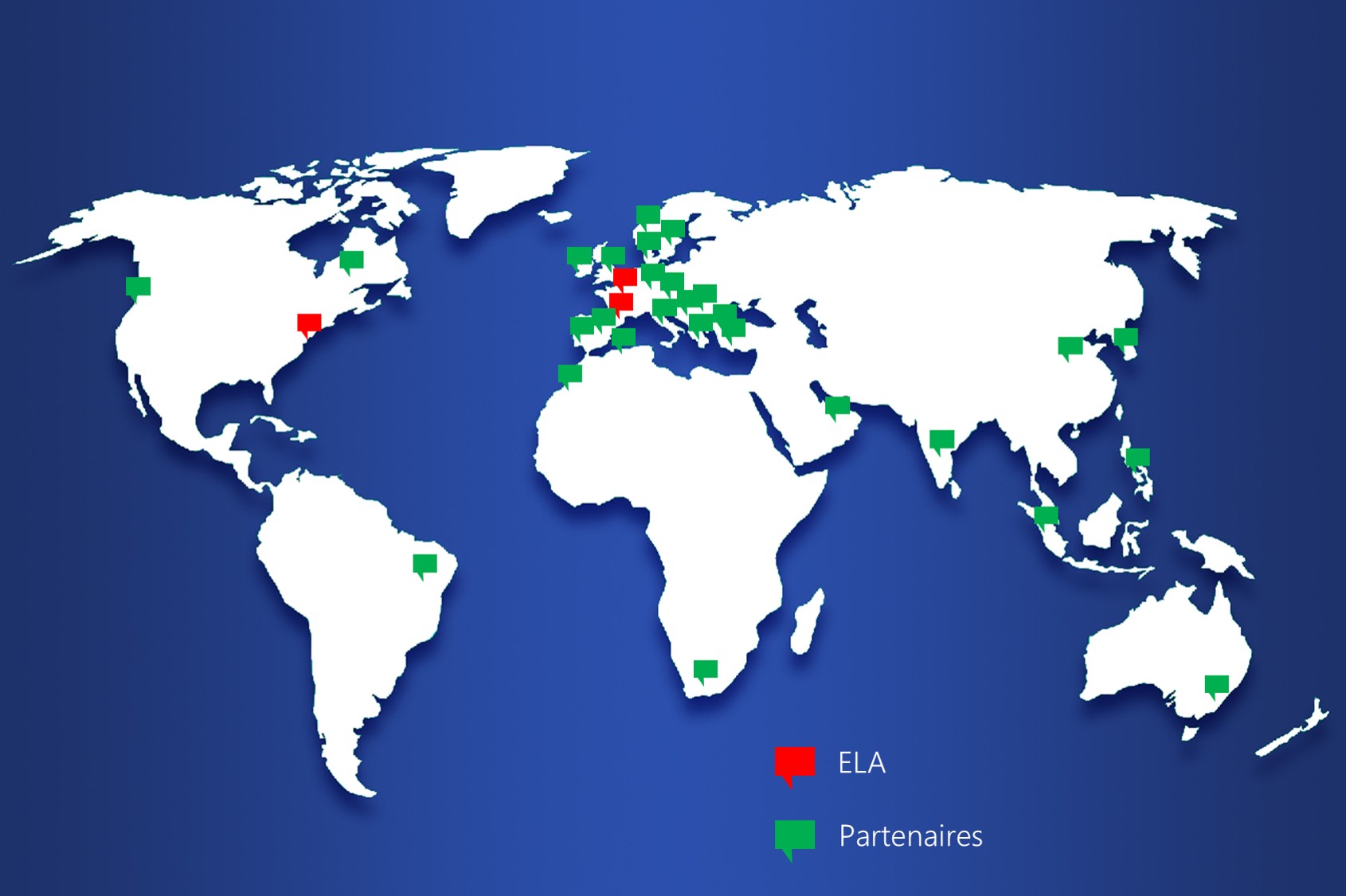

ELA intervient auprès des maîtres d’œuvre, des équipementiers et des start‑up pour sécuriser les architectures, les contrats et les interfaces avec les autorités (DGA, CNES, SGDSN, ANSSI), tout en préservant l’agilité nécessaire aux programmes et aux financements.

Dans un contexte de montée en puissance des exigences de souveraineté, de secret de la défense nationale, de cybersécurité et de contrôle des financements, ELA aide les acteurs de la base industrielle et technologique de défense à structurer des dispositifs de gouvernance et de conformité à la hauteur des attentes de l’État et des grands donneurs d’ordres.

Cette approche combine une compréhension fine des cycles de vie des programmes d’armement et spatiaux, des contraintes de l’économie de guerre et des impératifs d’innovation des start‑up, afin de transformer la conformité en levier de sécurisation durable des contrats et des relations avec les autorités.

ELA : 1er partenaire du NewSpace en France !

ELA est le principal partenaire des entreprises et startups du NewSpace en France, avec des références avérées: ~70% des acteurs du NewSpace nous font confiance aujourd'hui !.

Nous sommes régulièrement sollicités pour palier à une mauvaise approche/conseil et apporter des solutions pratiques, en étroite collaboration avec les autorités de tutelles.

Notre expertise métier et nos capacités d’analyse uniques sont largement reconnues sur l’ensemble de la chaîne de valeur spatiale.

Nous apportons un accompagnement sur les contrôles export ML/DU, la conformité à la loi Spatiale, les exigences AMA, la planification des fréquences, et les campagnes de tir ... dans une logique de partenariat de confiance à long terme

Concrètement, nous construisons des dispositifs conformité export, douane et cybersécurité adaptés aux filières défense et spatiale, capables de rassurer vos partenaires institutionnels et bancaires sans étouffer l’innovation ni la dynamique business.

Programmes défense & dual

ELA accompagne les industriels français de la défense et du dual‑use dans la sécurisation de leurs programmes sensibles, en alignant leurs pratiques contractuelles, organisationnelles et techniques sur les exigences de l’IGI 1300, de la LPM, de NIS2 et des régimes d’export control et de sanctions appliqués au secteur.

ELA aide à structurer une gouvernance compliance intégrée (export control, sanctions, cybersécurité, protection des informations sensibles) inspirée des standards des cabinets internationaux de référence : cartographie des risques, politiques et procédures, contrôle des tiers, gestion des accès et compartimentage, encadrement des coopérations internationales et des transferts de technologie.

ELA fournit enfin un appui opérationnel et stratégique aux directions juridiques, compliance, achats, DSI et aux organes de direction pour la gestion des relations avec les autorités (DGA, SGDSN, ANSSI, SBDU), la conduite des audits et enquêtes internes, le traitement des incidents (cyber, export, secret) et la démonstration, vis‑à‑vis des donneurs d’ordres étatiques, d’un dispositif de maîtrise des risques conforme aux meilleures pratiques du marché.

Spatial institutionnel & NewSpace

Positions orbitales, plans de fréquences, demandes ITU/ANFR, plans de sécurité campagnes de tir, PASI, conformité Loi Spatiale (+"Images"). Intégrer les exigences réglementaires et clients (agences, primes, opérateurs critiques) dès la conception des projets et des architectures.

Mise en place de dispositifs de conformité export et de protection des données sensibles adaptés aux acteurs traditionnels et aux modèles NewSpace (itérations rapides, levées de fonds, internationalisation), afin de sécuriser relations investisseurs, partenaires industriels et clients institutionnels.

Des compétences formateur-expert et consultant conformité ne sont pas suffisantes, une connaissance métier à jour est indispensable.

Le Spatial de 2026 n'est plus celui de 2010, les ingénieurs d'ELA ne vendent ni leur nom ni leur passé, ils sont confrontés quotidiennement aux problématiques du NewSpace, là où d'autres experts issue de "l'ancienne école" resteront souvent sur des schémas de pensée traditionnels.

ELA apporte une vraie expertise métier appliquée : comprendre l'architecture d'un segment-sol, un OBC, un SCAO etc. c'est accompagner les classements sur des bases techniques avérées. Connaitre les campagnes de tir et contraintes douanes liées c'est garantir le succès de vos opérations.